Fake Check Schemes

Overseas scam artists are defrauding American consumers. The latest complaints relate to counterfeit checks including cashier's checks, checks that look like they're drawn on business accounts, money orders, traveler’s checks and gift cheques. A common theme exists in all of the scams. If a deposited check shows as "funds available" in your account register, that doesn't necessarily mean it has cleared. Federal law gives consumers the right to have quick access to the funds from deposited checks (usually within 1 to 5 days).

Overseas scam artists are defrauding American consumers. The latest complaints relate to counterfeit checks including cashier's checks, checks that look like they're drawn on business accounts, money orders, traveler’s checks and gift cheques. A common theme exists in all of the scams. If a deposited check shows as "funds available" in your account register, that doesn't necessarily mean it has cleared. Federal law gives consumers the right to have quick access to the funds from deposited checks (usually within 1 to 5 days).

However, it can take weeks for counterfeits to be discovered. The consumer is then responsible for ALL fees associated with the fake check. Also, no one who wants to GIVE you money should ask you TO SEND THEM money.

Fake Check Scams generally fall into one of the following scenarios:

Foreign Business Offers: The potential victim receives an email from a supposed foreign official, businessman, etc. with a proposal. The sender desires to move large sums of money from a foreign country and needs assistance. The victim is usually offered a portion of the proceeds. If the victim agrees, he/she usually receives large denomination checks in the mail. The victim deposits the checks into his/her bank account and the funds are posted to the account and shown as "available." The fraudster wishes to send more money to the victim but quickly needs a portion of it returned in order to supposedly bribe an official, pay transfer fees, etc. The victim believes the previously deposited checks were genuine because the funds show as "available" in their bank account. So, he/she honors the request and wires a portion of the funds back to the fraudster. The original deposited checks are returned as counterfeit and the victim is responsible for the loss and associated fees.

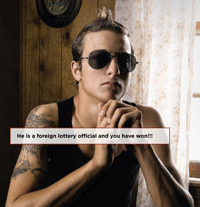

Sudden Riches: The potential victim receives a letter stating he/she has the right to receive a substantial sum of money. For example, the letter may state that the potential victim has won a foreign lottery or is the beneficiary of someone's estate (i.e., a long lost relative). The letter will inform the victim that he/she must pay a processing/ transfer tax or fee before receiving the money. However, a check or money order is enclosed to cover the required fee(s). The letter will ask the victim to deposit the check or money order into his/her bank account. Then he/she must wire the fee(s) to a third party, usually in a foreign country. This check or money order is eventually recognized as counterfeit and the victim is responsible for the loss and associated fees.

Work-at-Home Schemes: The potential victim answers an online advertisement or posts his/her resume on an Internet job search web site. The victim is awarded a job, “Payment Processing Clerk”, “Accounts Receivable Clerk”, etc. He/she is informed that the new employer is an international company located overseas. The company claims it costs too much to process U.S. checks in its own country. The victim's new job is to receive checks, deposit them into his/her bank account, and wire approximately 90% to them. This will save the company time and money (processing fees). The victim is instructed to keep 5-10 percent of the check value as his/her work-at-home salary. The victim deposits the check(s) and wires the money to the fictional employer when the funds are shown as available and posted to his/her account. It is done, of course, before the deposited check(s) actually clear. This check or money order is eventually recognized as counterfeit and the victim is responsible for the loss and associated fees.

Love Losses: A scam artist poses as a single looking for a relationship through an online dating service. As the online relationship progresses, the potential victim-partner is informed that funds are needed. These funds will cover the scam artist's travel expenses to the U.S. so the two can, “begin their life together.” The victim soon receives checks or money orders. The victim is instructed to deposit the check or money order into his/her bank account. Then he/she must wire a portion of the funds to cover the expenses of the new boyfriend/girlfriend. The funds are posted to the victim's account and he/she wires the money to the new boyfriend/girlfriend. This check or money order is eventually recognized as counterfeit and the victim is responsible for the loss and associated fees.

Overpayments: A fraudster offers overpayments on items you advertised in the classified or online auctions. First, they provide you with a check or money order for more than the purchase price. Then they ask you to send the extra to someone who will take care of shipping. But there's no reason why they can't send that person the money directly. In another scenario, the scam artist says a check or money order will come from someone who owes them money. They instruct the victim to deduct his/her share and send them the rest. Maybe they're in a foreign country and because of currency differences it's difficult to make payment directly. But it's easy to transfer money electronically from anywhere - there's no reason to have someone else send payment. Fraudsters sometimes claim they sent the wrong amount "by mistake" and ask victims to return the excess. Legitimate buyers will be happy to send the exact amount you're owed.

Rental Schemes: Finding a good roommate or someone reliable to rent your vacation property is hard enough without getting tangled up in a fake check scam. Learn the warning signs:

- They claim to be moving from outside the area, even from another country. They send a check or money order for rent in advance plus extra for the cost of shipping their belongings. They ask you to forward the shipping money to someone, but they can just as easily send it themselves.

- They have unexpected expenses and ask you to cash a check or money order or send some of the deposit back as a favor. But they never intend to move in, and by the time you discover the scam they’ve moved on to the next victim.

- Their check or money order for the vacation rental includes extra to rent a car. They ask you to send the extra to someone who will make those arrangements.

REMEMBER: Legitimate renters will be happy to send the exact amount you’re owed.

For more information, visit: USPIS - Check Fraud